Comprehending Jumbo Loan: What You Need to Know for Deluxe Home Purchases

Comprehending Jumbo Loan: What You Need to Know for Deluxe Home Purchases

Blog Article

Browsing the Jumbo Lending Landscape: Important Insights for First-Time Homebuyers

Navigating the complexities of big lendings offers an unique set of obstacles for newbie homebuyers, especially in an evolving actual estate market. Recognizing the crucial eligibility demands and potential advantages, alongside the disadvantages, is crucial for making educated choices. Furthermore, establishing a solid economic method can dramatically enhance your potential customers.

Comprehending Jumbo Finances

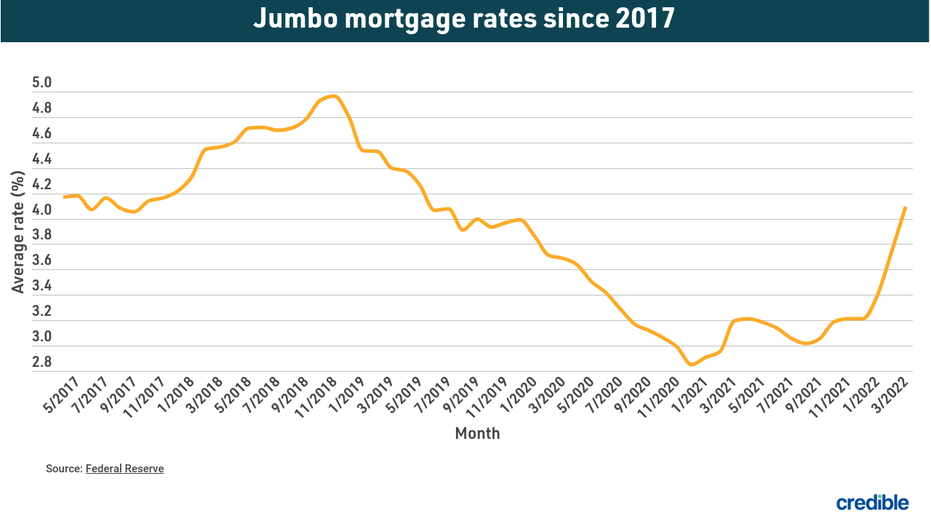

Because big financings are not backed by government-sponsored entities, they lug various underwriting requirements and require even more extensive economic documents. This difference can cause higher rate of interest compared to traditional financings, provided the boosted danger to lending institutions. Nonetheless, big finances also supply distinct advantages, such as the ability to finance higher-value residential or commercial properties and potentially extra versatile terms.

New property buyers need to also know that protecting a jumbo financing usually necessitates a bigger deposit, commonly varying from 10% to 20%. In addition, borrowers are usually anticipated to show solid credit reliability and a stable revenue to qualify. When checking out big financing alternatives in their quest of homeownership., comprehending these subtleties can empower novice buyers to make informed choices.

Qualification Requirements

Protecting a jumbo loan calls for conference particular qualification needs that differ considerably from those of traditional fundings. Unlike standard loans, which are commonly backed by government-sponsored entities, big loans are not guaranteed or assured, resulting in more stringent standards.

In addition, debtors should demonstrate a durable monetary profile, which consists of a low debt-to-income (DTI) proportion, normally no greater than 43%. This ensures that customers can manage their month-to-month repayments together with various other monetary responsibilities.

Moreover, many loan providers require significant paperwork, consisting of evidence of income, asset statements, and income tax return for the previous 2 years. A substantial deposit is likewise essential; while conventional financings might allow deposits as reduced as 3%, jumbo loans frequently require a minimum of 20%, relying on the loan and the loan provider quantity.

Advantages of Jumbo Lendings

For lots of first-time buyers, jumbo lendings supply distinct benefits that can promote the journey towards homeownership. One of the main advantages is the capability to fund residential or commercial properties that exceed the adapting financing limits established by government-sponsored entities. This adaptability enables purchasers to access a larger series of high-value buildings in affordable property markets.

In addition, jumbo finances usually feature appealing rates of interest that can be reduced than those of typical financings, especially for borrowers with solid debt accounts. This can result in significant savings over the life of the funding, making homeownership extra affordable. Moreover, big fundings generally enable greater loan quantities without the requirement for exclusive home loan insurance policy (PMI), which can additionally minimize regular monthly settlements and overall expenses.

Possible Disadvantages

Lots of possible property buyers might find that big lendings come with significant drawbacks that necessitate careful consideration. One of the main issues is the strict credentials standards. Unlike adjusting financings, jumbo loans generally call for higher credit rating, usually going beyond 700, and substantial income documents, making them less obtainable for some debtors.

Furthermore, big lendings typically include higher rate of interest rates contrasted to standard lendings, which can lead to increased monthly payments and total borrowing prices. This costs may be particularly burdensome for newbie buyers who are already browsing the financial complexities of acquiring a home.

Another notable downside is click here for more info the larger deposit requirement. Many lending content institutions expect a minimum deposit of 20% or even more, which can pose a difficulty for customers with restricted financial savings. The absence of federal government support for big finances leads to much less beneficial terms and conditions, enhancing the danger for loan providers and, consequently, the borrowing prices for homeowners.

Finally, market variations can dramatically influence the resale value of high-end residential or commercial properties financed with jumbo loans, adding an element of economic unpredictability that first-time homebuyers may find daunting.

Tips for First-Time Homebuyers

Navigating the intricacies of the homebuying procedure can be frustrating for newbie purchasers, particularly when thinking about jumbo fundings (jumbo loan). To streamline this trip, adhering to some key approaches can make a significant distinction

First, inform on your own on jumbo lendings and their certain demands. Recognize the different financing requirements, consisting of credit report, debt-to-income proportions, and down settlement assumptions. Usually, a minimum debt score of 700 and a deposit of at the very least 20% are vital for authorization.

Second, involve with a well-informed home loan specialist. They can supply insights tailored to your monetary scenario and aid you navigate the ins and outs of the big lending landscape.

Third, think about pre-approval to reinforce your acquiring position. A pre-approval letter signals to sellers that you are a serious customer, which can be advantageous in open markets.

Lastly, do not overlook the significance of budgeting. Variable in all expenses associated with homeownership, consisting of real estate tax, maintenance, and homeowners' insurance policy. By complying with these pointers, novice Full Report purchasers can come close to the jumbo lending procedure with better self-confidence and quality, improving their possibilities of effective homeownership.

Verdict

In verdict, navigating the jumbo funding landscape calls for an extensive understanding of qualification standards, benefits, and prospective disadvantages. Ultimately, detailed preparation and education and learning relating to big fundings can lead to more educated decision-making in the homebuying process.

When navigating the intricacies of the real estate market, recognizing big fundings is critical for newbie buyers intending for residential or commercial properties that go beyond standard financing limits. Jumbo fundings are non-conforming fundings that typically go beyond the adhering financing limitation established by the Federal Real Estate Financing Company (FHFA)In addition, jumbo financings typically come with appealing interest prices that can be lower than those of typical fundings, particularly for customers with solid credit report profiles. Big lendings generally enable for higher lending amounts without the need for exclusive home loan insurance (PMI), which can additionally minimize total prices and regular monthly settlements.

Unlike conforming finances, jumbo car loans typically call for greater credit report ratings, frequently surpassing 700, and substantial revenue documents, making them less available for some borrowers.

Report this page